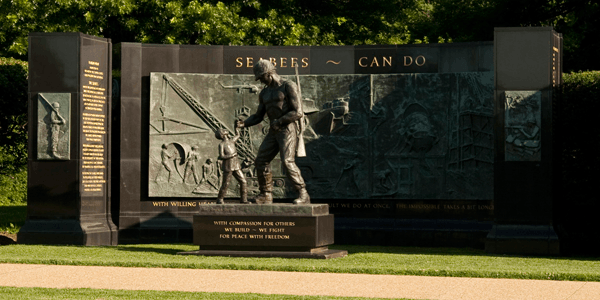

Make a Difference for Generations to Come

Make a Difference for Generations to Come

Ways You Can Give to Make a Difference

Planned Giving

About Bequests

You may be looking for a way to make a significant gift to help further our mission. A bequest is a gift made through your will or trust. It is one of the most popular and flexible ways that you can support our cause.

IRA Charitable Rollover

An IRA rollover allows people age 70 1/2 and older to reduce their taxable income by making a gift directly from their IRA.

Beneficiary Designations

A beneficiary designation gift is a simple and affordable way to make a gift to support our cause. You can designate our organization as a beneficiary of a retirement, investment or bank account or your life insurance policy.

Charitable Gift Annuities

A charitable gift annuity is a great way you can make a gift to our organization and benefit. You transfer your cash or property to our organization and we promise to make fixed payments to you for life at a rate based on your age.

Donor Stories

Learn how others have made an impact through their acts of giving to our organization and others. Explore the many benefits of charitable gift planning.

Gift Options

Find out What to Give and learn about the best assets to make a planned gift. Learn about gifts of cash, securities and property. Learn How to Give and discover gift options that provide tax and income benefits. Discover the best planned gift to meet your goals.

Monday April 29, 2024

Washington News

IRS 2022 Tax Return Checklist

1. Gather Tax Records — Taxpayers need to gather their records for the tax return. You will need Social Security numbers for all of family members, your bank account and routing numbers to file electronically, IRS Forms W-2, 1099 and 1098. You should have IRS Form 1095-A, Health Insurance Marketplace, and any letters sent to you from the IRS.

2. Report All Income — The IRS reminded taxpayers that all income is taxable. Some individuals inadvertently do not report income from goods sold online, investments, part-time or seasonal work, self-employment or income from mobile applications or the Internet. All these forms of income should be reported on your tax return.

3. File Electronic Return — The quickest and easiest way to file is electronically. You will receive the most prompt refund by filing electronically and selecting direct deposit to your financial institution. If taxpayers have not yet had their 2021 tax return processed, they should enter in $0 for their last year of adjusted gross income (AGI). Everyone else should enter their 2021 AGI on the appropriate field.

4. Free IRS Resources — The IRS provides a number of free resources to assist in filing. The IRS Free File software is available for taxpayers with incomes of $73,000 or less in 2022. There are seven Free File products in English and one in Spanish. They may be accessed through IRS.gov. You also may benefit from the Volunteer Income Tax Assistance (VITA) or the Tax Counseling for the Elderly (TCE) programs.

5. Charitable Gifts Over $250 — Gifts of $250 or more to a charity require a receipt. The receipt issued by the charity must state that no goods or services have been transferred in exchange for the gift. If the donor receives something in return from the charity, the deduction value is reduced by the value of that item. If a taxpayer receives something in return for a gift over $75, the charity must make a good faith estimate of the value of the goods or services transferred to the donor and disclose the estimate. In addition, the taxpayer must receive the receipt from the charity prior to filing his or her tax return.

6. Property Gifts Reporting — If a person makes a noncash charitable contribution greater than $500, he or she must include IRS Form 8283 with his or her tax return. The first section of Form 8283 includes Part A, a description of the property. If the property is publicly traded stock, only Part A is required.

7. Property Gift Appraisals — Property gifts with value over $5,000 often require an appraisal and filing IRS Form 8283. The appraisal includes a description of the property and the name, address and taxpayer identification number of the appraiser. The appraiser's qualifications regarding the type of property being valued must be included in the qualified appraisal. The appraiser must disclose if he or she is acting in the capacity as a partner of a partnership, an employee of any person or as an independent contractor engaged by someone other than the donor. The appraisal must state that it was prepared for "income tax purposes."

8. Qualified Appraisers — A "qualified appraiser" is an individual with "verifiable education and experience in valuing the type of property for which the appraisal is performed." The education and experience requirements may be met by successfully completing college-level or professional-level coursework in valuing the type of property being appraised and having two or more years of experience valuing that type of property.

Previous Articles

IRS Reminder To Report Digital Asset Income

Free File Launched on January 13

2023 Tax Filing Season Opens on January 23